ITR-V | Learn To Revise, Send, Download & Check ITR-V Receipt Status

- December 21, 2018

- Posted by: Editorial Team

- Category: Income Tax

Overview

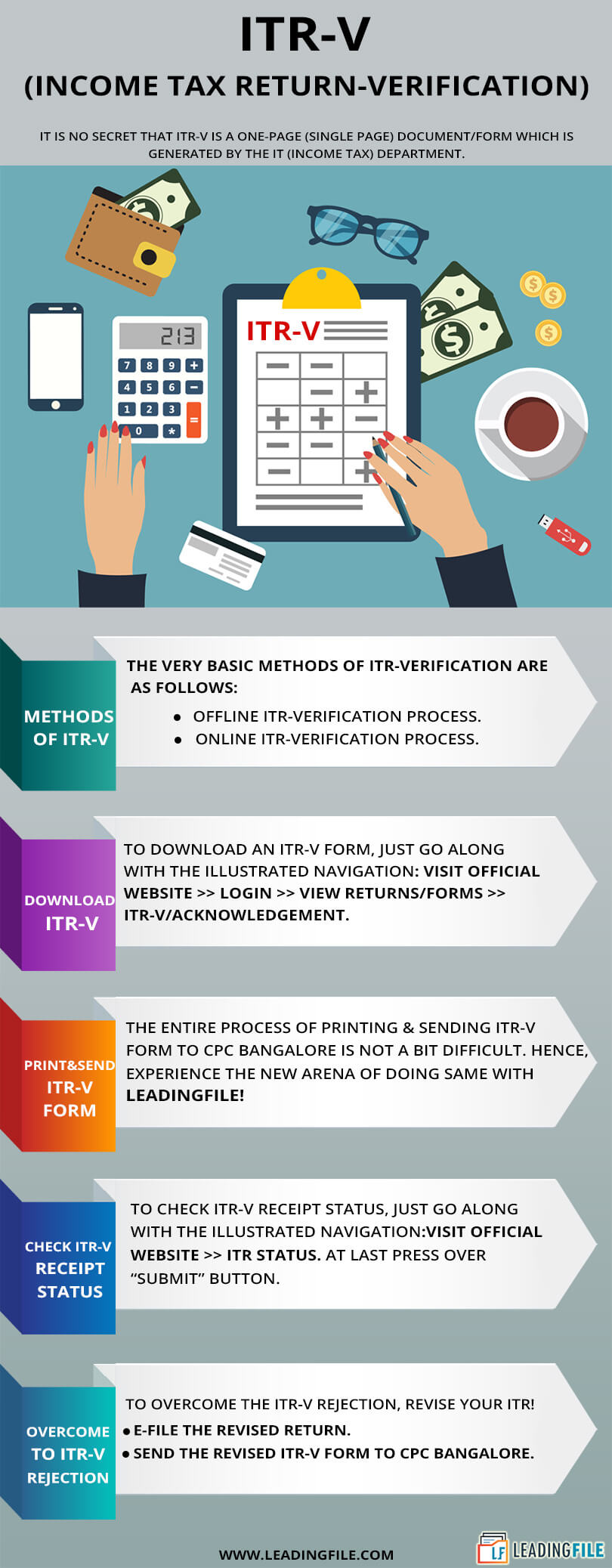

Concerning the “ITR-V” fact to you – If you had filed your tax returns and till not processed the verification step, then, your whole ITR (Income Tax Return) process is incomplete!

Well, it is summed up that the verification of ITR is not a doddle. Even the downloading & checking process of ITR-V receipt status/form is not a bit easy.

Looking at this – we brought a complete encapsulated guide for you over: What ITR-V means, How to download ITR-V, How to check ITR-V receipt status and much more.

Before all, let’s fragment & discuss the same in detail…

ITR-V | What ITR-Verification Means

Generally, ITR-V is the combination of two words i.e, ITR & V! Both have their own meaning and standards, but, together they formulate a single phrase which stands for “Income Tax Return – Verification.”

On the other hand, ITR-V means – a form belonging to the income tax return – verification.

It is no secret that[popup_anything id=”2710″] is a one-page (single page) document which is generated by the IT (Income Tax) department. Holding the acknowledgement about your returns, whether they are successfully submitted to the income tax department or not.

But the question is – for whom & why it is generated? Well, it is generated for the taxpayers and to verify the legitimacy of their tax e-filing.

Note: (1) You need to sign an ITR-V form with the blue ink and send the same form via ordinary post or speed post despite the courier.

Note: (2) Applicable for only those who file an ITR-V form online – without DS (Digital Signature). On the other hand, it (ITR-V) is not required in case you have submitted your ITR (Income Tax Return) form online via using the digital signature.

Fast forward – one can get it from the linked email ID along with the PAN, but only after filing the ITR.

And once the ITR got filed, the step of verification can be processed. To which the IT department verifies your submission by checking the authenticity of your e-filing and generates ITR-V by accepting your tax return.

More likely, it can be verified into two manners, which we have discussed below.

Verification Of ITR: Quick Methods

If you are done with ITR form filing, then, verification of the ITR form is a must!

Following are the very basic methods of ITR-Verification by which one can claim to his/her returns; elaborated as follows:

Let’s discuss them in detail…

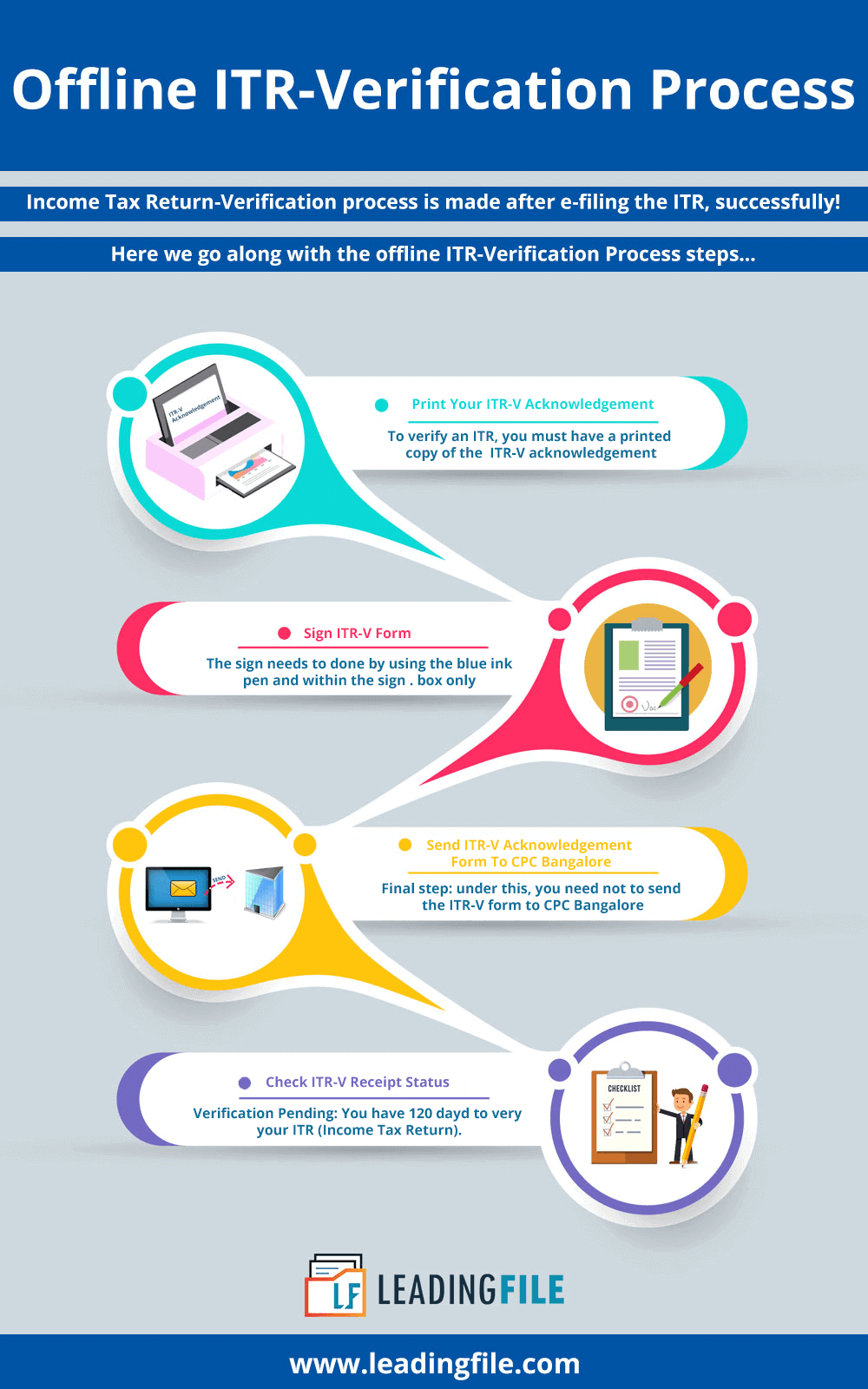

Offline ITR-Verification Process

This procedure includes step by step process to physically verify your ITR. Once you’re done with the offline ITR-Verification process, thereafter, you just need to send a physical copy of signed ITR-V form to CPC Bangalore.

For the sake of same – simply follow the steps illustrated as follow:

ITR-Verification Process Steps

Itself the ITR-Verification process steps need to be placed after the downloading ITR-V phase. But letting the flow go on, made it a little bit conservative to discuss the same.

So, once you’ve downloaded your ITR-V, you need to overcome the below-illustrated steps to complete the income tax return verification:

Let’s get engaged with same…

![]()

Print Your ITR-V Acknowledgement

To verify an ITR, you must have a printed copy of the same. Hence, over to the first step, take out a print of your ITR-V acknowledgement from your e-mail.

However, while printing the form, you must keep in mind that it should be printed with dark black ink. Along with that, make sure that the printed copy is visible to eyes.

![]()

Sign ITR-V Form

Over the second step, you need to sign the ITR-V form. But, the sign needs to done by using the blue ink pen and within the box provided for the same purpose.

Few of the amenities which one need to keep in mind while and after making sign over the ITR-V form are illustrated below:

- Firstly – make sure that the signature doesn’t exceed beyond the border of the box.

- Don’t staple the ITR-V acknowledgement form.

- Never fold the portion which contains the barcode.

- Enclose the ITR-V application form in a white A4 size envelope.

- Last but not least, if you’re sending multiple ITR-V forms together, then use a separate envelope for each and every form.

This leads to the end of step second, now formulate the ITR-V form for sending. Keep reading…

![]()

Send ITR-V Acknowledgement Form To CPC Bangalore

Under this alternative, one needs to send the sample signed ITR-V form to CPC Bangalore.

But, the condition is – you can only send the form either through speed post or ordinary post despite couriering it. Along with that, the form should be sent within 120 days of e-filing your returns.

It too holds a relaxation i.e, you need not to send any of the supporting document along with the ITR-V form, just a sample signed ITR-V application form page is enough.

Now, one might will be thinking of address to which s/he can send the ITR-V form. Here it goes: Income Tax Department – CPC, Post Box No.1, Electronic City Post Office, Bangalore-560500, Karnataka.

Further on, once the CPC (Centralized Processing Centre) Bangalore receives your form, it will send you an email regarding the same and will start processing your ITR.

All done!

Now, you may visit your ITR-V, as off – you have completed the physical verification of your ITR (Income Tax Return).

Online ITR-Verification Process

If you’re not familiar with the online ITR-Verification process, then, keep going…

Depicted one – is another method of verifying ITR, done online via using EVC and known to be e-verification of ITR. Well, in accordance with e-verification, at IT (Income Tax) department there are numerous options to verify your income tax returns.

To which the only thing one needs to do is just generate an EVC (Electronic Verification Code), which is the wholly key to make your tax return online under any of the e-verification portals.

Keep going with the depicted anchor text: [simple_tooltip content=’Till date, time is the major concern in all!

Hence, to make the dreams come true, the government has come out with a process named E-Verify ITR. Where the verification of ITR is done via EVC (Electronic Verification Code).

Let’s fragment “E-Verify ITR” and discuss it in detail… Here!’]E-Verify ITR || 6: Quick Methods To – Online ITR E-Verification[/simple_tooltip].

Download ITR-V: Easy & Native Steps

In accordance with the research, at present, the process of downloading ITR-V is not that much difficult. But is over high demand!

Admirably, over 880 users in a month use to search – how to download ITR-V acknowledgement.

And if you are willing to know the reason behind this – then it must be the ratio of peoples who don’t use the digital signature to file their tax return. Further to which one need to download & submit an ITR-V application form at the departmental website.

Overlooking at the same issue, we concluded the flexible and easiest steps for accomplishing the complete downloading ITR – V process, successfully to you.

Keep going! Let’s discuss them in detail…

![]()

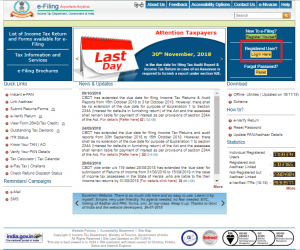

Visit Official Website

Under this alternative step, you need to visit the official website of the IT department, depicted below the anchor text: as: incometaxindiaefiling.

![]()

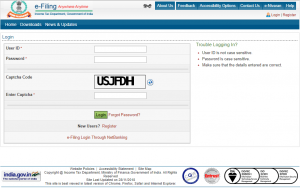

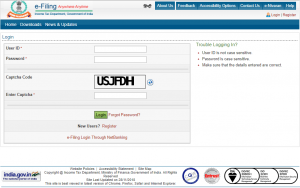

Click Over: Login Here

The very first thing one needs to do after following the official website link is – press over “Login Here” button.

Well, if you don’t have an account, then, you need to click over “Register Yourself” button. To which you need to assign the required details.

After getting done by this registration, a login window will pop-up in front of you. Where you need to fill up; User ID, Password and Captcha Code by using the appropriate credentials.

Note: Credentials to your account will go as illustrated below;

User ID – Your PAN card number.

Password – Together; your PAN card number and date of birth.

Captcha Code – Illustrated below in dialog box.

For instance: (example to the ITR -V form password)

PAN No.: AAAPA0001A,

Date Of Birth: 23/01/1990,

Your ITR-V Form Password: aaapa0010a23011990.

Fast forward, have a look at the above-illustrated image above to understand the things in a better and native manner.

![]()

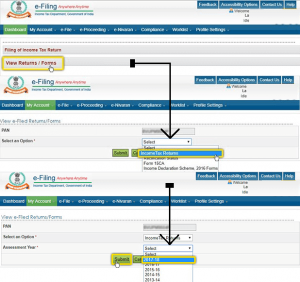

Go Along With View Returns/Forms & Select “Income Tax Return”

Meanwhile, under this step, you need to go along with two alternative steps, all together. Where the first part says click over “view returns/forms” and second part says select “Income Tax Return” along with the assessment year.

Images to represent both step working is as follows:

Finally, you need to press (click) over the submit button, which will redirect the window page to the last step.

![]()

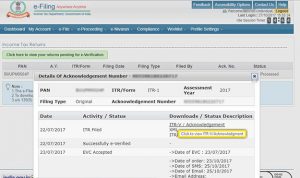

Click Over: ITR-V/Acknowledgement

The last step goes on by selecting the acknowledgement number of the particular ITR for which you wish to download the ITR-V.

Further on, select the ITR-V/Acknowledgement to begin the download. Image to understand the same is attached as follows:

All done! Now, you may visit your ITR-V form.

But it’s not the end, now you have to print and send your ITR-V to CPC – Bangalore for further verification. Those who are not aware of sending or submitting ITR-V online, keep reading…

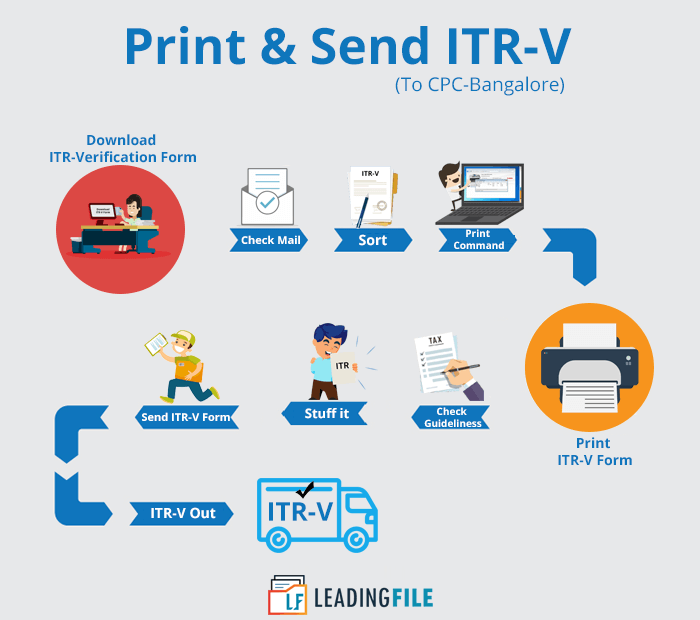

Print & Send ITR-V Form To CPC-Bangalore

Experience the new arena of printing & sending ITR-V form online with LeadingFile!

Some of the best guidelines to print ITR-V form are illustrated as follows:

- ITR acknowledgement form should be printed in black ink only, don’t use any other ink to print the ITR-V.

- Over second – only A4 size sheets should be used while printing an ITR-V form.

- Don’t make use of stapler on ITR-V acknowledgement.

- Signatures photocopy of ITR-V form will not be accepted.

- Despite using dot matrix printer, make use of inkjet or laser printer only.

- Barcode and the numbers below the code should be clearly visible in the ITR-V acknowledgment form.

So, this was all about the printing schema. Fast forward, if you got any hassle during the entire ITR-V working process then go along with our pro-advisor.

Getting back to the stuff; i.e, send ITR-V form to CPC Bangalore!

The entire process of sending ITR-V form to CPC Bangalore is not a bit difficult. The only thing you need to know is the address of CPC Bangalore, where you have to send/submit the ITR-Verification form.

Well, to the known talks, the IT (Income Tax) department has allotted a new address to CPC (Centralized Processing Centre) Bangalore.

Whereas on the other hand, itself the DOP (Department Of Post) has allotted a unique PIN code (560500) to CPC. To which the taxpayers can henceforth their ITR-V forms and other documents via mails to the centralized processing center.

But the whole things can be done only after downloading & printing the ITR-V form, from the IT (Income Tax) departmental website. Soon after downloading, you just need to open it and print the same by logging in at the departmental portal.

Fast forward, mail the printed ITR-V form at the appropriate address. However, if you are no very well aware of the CPC new address then keep going…

New Address Of CPC-Bangalore For Speed Post

- Post Bag No.1,

- Electronic City Post Office,

- Bengaluru, Karnataka 560100.

Next to this activity, one must check the status of ITR-V form. Don’t hassle, we are always there for you. Keep reading…

ITR-V Receipt Status | How To Check ITR-Verification Status

It is no secret that ITR-V receipt status checking is indeed!

Now, one must be having few questionnaires in his/her mind; as – what made the checking indeed and what ITR-verification receipt status is?

Quite easy: the rejection of ITR-V receipt made the checking indeed. As off, sometimes the receipt falls under the rejection state. And to overcome the same within the time, one needs to check the status of his/her ITR-verification receipt.

Note: You must keep a regular eye over your ITR-V receipt status. Just to ensure that the delivery to CPC Bangalore goes within time (120 days) from the date of uploading your ITR.

Over to the next questionnaire; i.e, what ITR-V receipt status is – “status, to which your ITR falls.”

But; what are those ITR-V status? Generally, we opt to have the two status, belonging to your ITR-V receipt, illustrated as follows -:-

- ITR-V Rejected.

- ITR-V Submitted Successfully.

Further, if you have selected to verify your tax return via CPC refund status by sending ITR-V, then, the following steps could help you to check the receipt status:

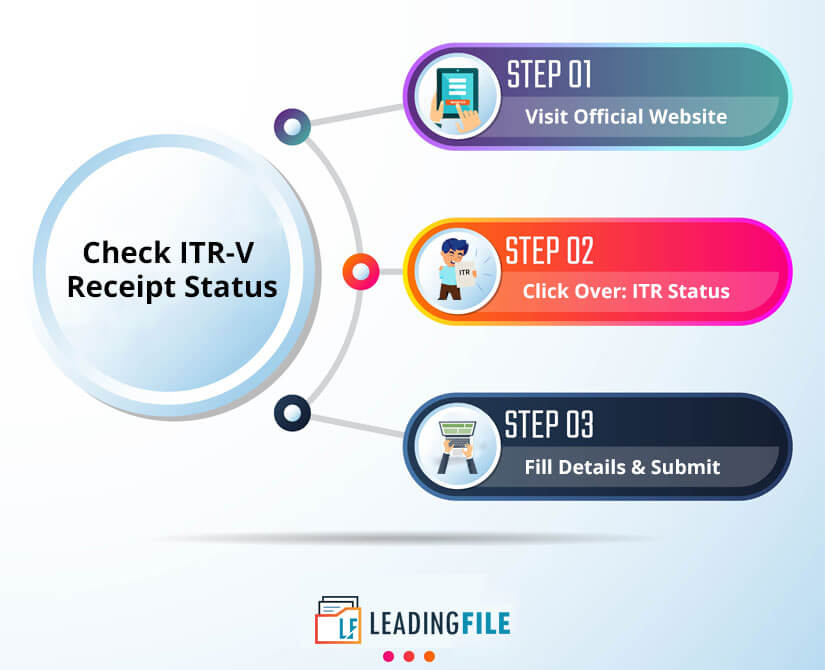

Check ITR-V Receipt Status: Step-By-Step Guide

Let’s have a look at the easiest & most flexible steps to check ITR-V receipt status, elaborated as follows;

![]()

Visit Official Website

To this alternative step – one just needs to visit the official website of IT (Income Tax) department. However, you may go through it via the above-depicted link, under step 1 of the easy steps to download ITR-V.

![]()

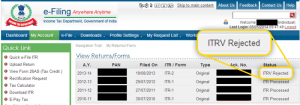

Click Over: ITR Status

Among all one of the most important step, towards verifying ITR-V receipt status.

To which, one needs to press (click) over ITR status which is depicted under the drop-down menu of quick links. An image to understand the step in better & native manner is attached below:

![]()

Fill The Required Details

A new window page will appear next by following the step second over ITR platform.

Have a look at the below-attached image, it will help you in knowing the required details: likely to be contained: your PAN, acknowledgement number & captcha code.

Last but not least, press (click) over the “Submit” button.

As soon as you press over it, the sooner, the website will show you entire ITR-V status information! Whether they are rejected or got submitted successfully.

But what if the ITR-V got rejected, it somehow means you didn’t receive the acknowledgment. Let’s discuss it in detail with a proper heading.

ITR-V Rejected | What To Do If ITR Got Rejected

Admirably, it’s not a big deal to overcome the ITR-V rejection! But, before all one should know about the ITR-V status i.e, “ITR-V Rejected”, and the reasons behind why ITR got rejected.

Being contiguous, it’s a case which arises when you e-file your income tax return, but the ITR-V status found to be rejected.

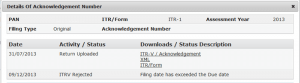

An image to understand is as follows:

But, why it got invalid? Let’s deal with the reasons…

Reasons Behind The ITR-V Rejection

Following illustrated are the very basic reasons behind the ITR-V rejection:

- Filing date has exceeded the due date.

- Improper delivery and overwriting in ITR_V form.

- Poor quality documents & signature missing from the ITR-V application.

For instance: let’s visit an image to recognize the first reason.

Note: You’ll only be able to see the reason for rejection by clicking over the acknowledgement number.

Literally, it somehow it means that you are looking at the process of overcoming ITR-V rejection. And too means that you are done with e-filing of your income tax return.

So, keep calculating! Here we go with the revision of ITR-V…

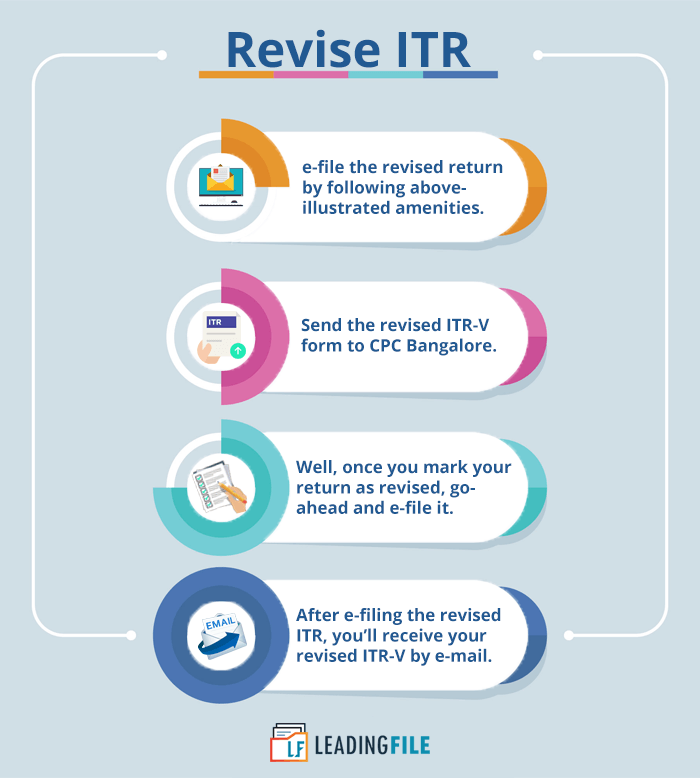

Revise ITR | How To Revise Income Tax Return

Meanwhile, you are willing to know – how to revise ITR (Income Tax Return)? Need not to worry, the entire process to revise ITR is same as filing an original ITR.

But if it was so then why one need to revise it. Here’s a twist!

The entire process of e-filing an ITR is the same, but – one is required to file it (Revised ITR) under the income-tax act, section 139(5). To which you need to opt the option – “17 – Revised u/s 139(5)” from the ‘return filed’ column.

Further on, the e-filing revision portal will additionally ask you for the details of the original ITR, likely to be contained – ITR receipt number and date of filing the original ITR.

Now one might a questionnaire in his or her mind – is there any last date to file a revised ITR?

Yes, to the known facts, you can e-file a revised ITR within one year after the expiry of the assessment year. Let’s get engaged with the steps of doing so and so…

Easy Steps To Revise Your ITR

Below listed are the easiest steps to revise ITR acknowledgement:

- e-file the revised return by following above-illustrated amenities.

- Send the revised ITR-V form to CPC Bangalore.

- Well, once you mark your return as revised, go-ahead and e-file it.

- After e-filing the revised ITR, you’ll receive your revised ITR-V by e-mail.

- Last but not least, print a copy and send it to the CPC Bangalore.

That’s all in terms of easy steps to revise your ITR (Income Tax Return).

Wind-Up

The utmost important phase of any of the blog post!

This was all, which one needs to understand about ITR-V (Income Tax Return-Verification) in bold. Moving on – here in this blog, we have discussed all the thesis of ITR-V.

Likely to be contained: methods to verify, revise, check, print, send & download ITR-V receipt status.

As we all know that dealing with the above-illustrated thesis is not a doodle, but here we made the dreams come true. Subsequently, this adds value to any of the blog posts and often leads to the end of our blog post.

All done! Enjoy and don’t forget to comment. Also, share the blog with your peers. You are on your way of getting more & more exposure.