How To E-Verify ITR Through

E-Verify ITR Through Axis Net Banking [Step-By-Step Guide]

- July 1, 2019

- Posted by: Editorial Team

- Category: Income Tax

![E-Verify ITR Through Axis Net Banking [Step-By-Step Guide]](https://leadingfile.com/wp-content/uploads/2019/06/E-Verify-ITR-Through-Axis-Net-Banking-Step-By-Step-Guide.jpg)

Overview

We all are too worked up these days – so, going to ITR office and submitting the ITR-Verification form physically is something impossible.

Not only this much, sending signed [popup_anything id=”2710″] physically to Bangalore is also an obstacle in going green || going paperless.

Then — what’s the way? Ease; e-verify ITR through – axis net banking. But this way of e-verification only gets enabled later to [popup_anything id=”3621″] (Income Tax Return).

Mark-1: You’re not supposed to go with axis net banking only, you can also opt to have any other banking method or you too can opt to have any other e-verification method, mentioned as — [simple_tooltip content=’E-Verify ITR; in complete stands for e-verification of ITR (Income Tax Return)!

But, what e-verification of ITR means? E-Verification of ITR somehow means electronic verification of the ITR, where the taxpayer verify his/her tax returns via generating EVC (Electronic Verification Code).

And from the known fact…Read More‘]E-Verify ITR || 6: Quick Methods To – Online ITR E-Verification[/simple_tooltip].

All right! We know this is kinda off topic nevertheless, we’d figured — we should ask. Do you pay tax from your earnings? Look; paying taxes is not only one’s legal responsibility but also a moral duty. Also, the thing is – how you pay it (the mode of filing your tax return)?

Certainly, if you are still filing your tax returns through the traditional ‘postal’ method, then it’s time that you switch to the new-age e-filing system of filing your tax returns.

However, it’s very simple, and saves your plenty of time and efforts as well..!!!

Thus, needless to mention that with the introduction of electronic verification (e-verification) system by the government of India, filing one’s income tax returns (ITR) have now become a hassle-free experience.

Ok, we agree! But what this e-verification || ITR is? Ease; ITR-V, and what this ITR-V is? Don’t panic, visit it here – [simple_tooltip content=’Concerning the “ITR-V” fact to you – If you had filed your tax returns and till not processed the verification step, then, your whole ITR (Income Tax Return) process is incomplete! Complete it today @LeadingFile‘]ITR-V | Learn To Revise, Send, Download & Check ITR-V Receipt Status[/simple_tooltip].

Going forth, keep reading the same article, to visit the process of e-verifying your ITR through axis bank net banking service…

E-Verify ITR Through Axis Bank Net Banking Service: June Updated

In accordance with the updated information, online axis net banking – beeps at the top.

As said – “Make things easier and win the loyalty.” Something similar is also about the axis bank, they made the net banking services easier and became loyal to all. Services like — axis bank net banking payment, axis net banking: ITR e-verification, axis customer care, and its 24-hour emergency helpline number (+91 22 67987700) is the icing on the cake.

Even, the axis bank online net banking password generation service is down to earth.

Somewhere and somehow. all these services made the axis bank, loyal. So, those who wish to e-verify their ITR can opt to have the benefit of axis net banking service loyalty.

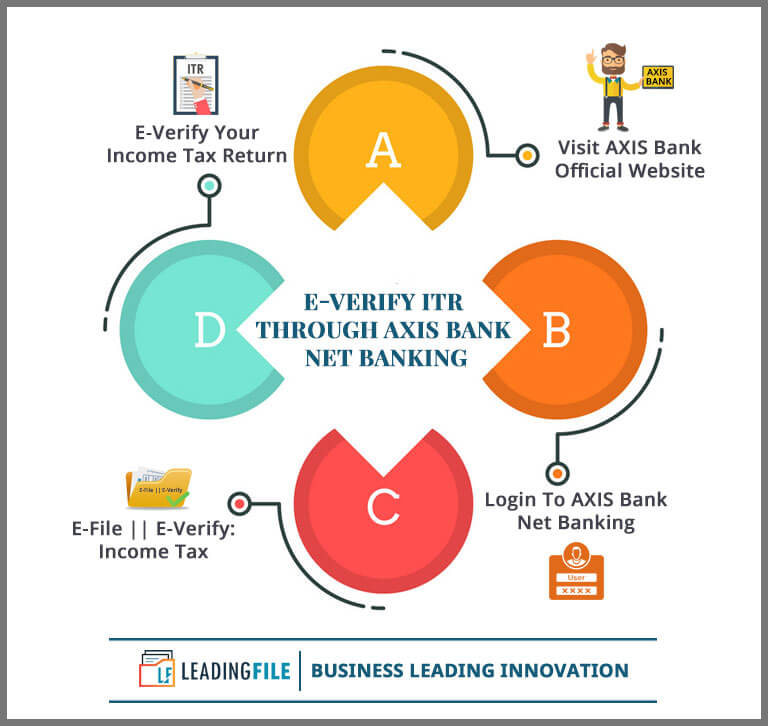

Here we go; steps to execute the ITR e-verification through axis net banking is as follows:

![]()

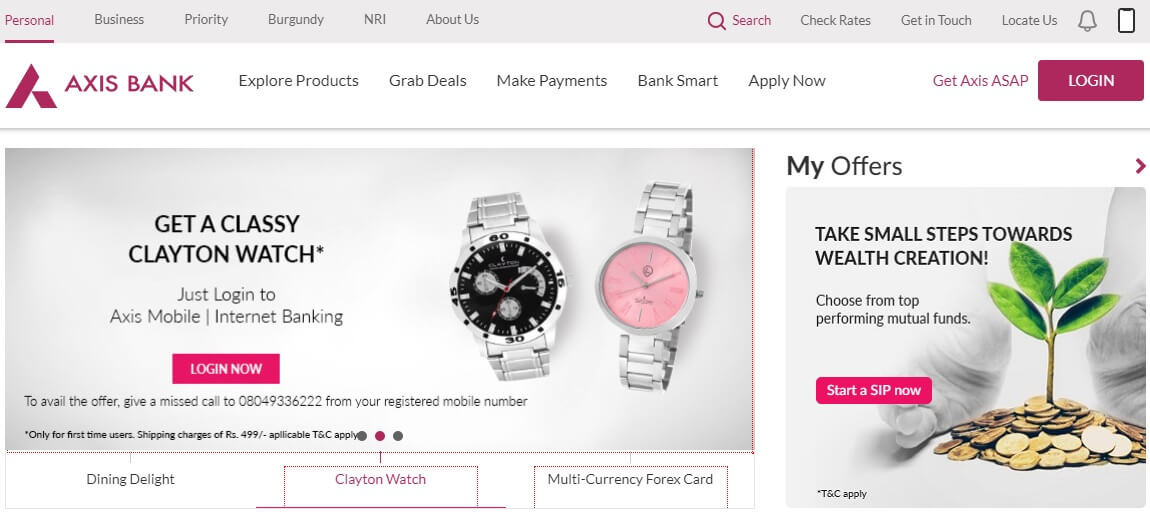

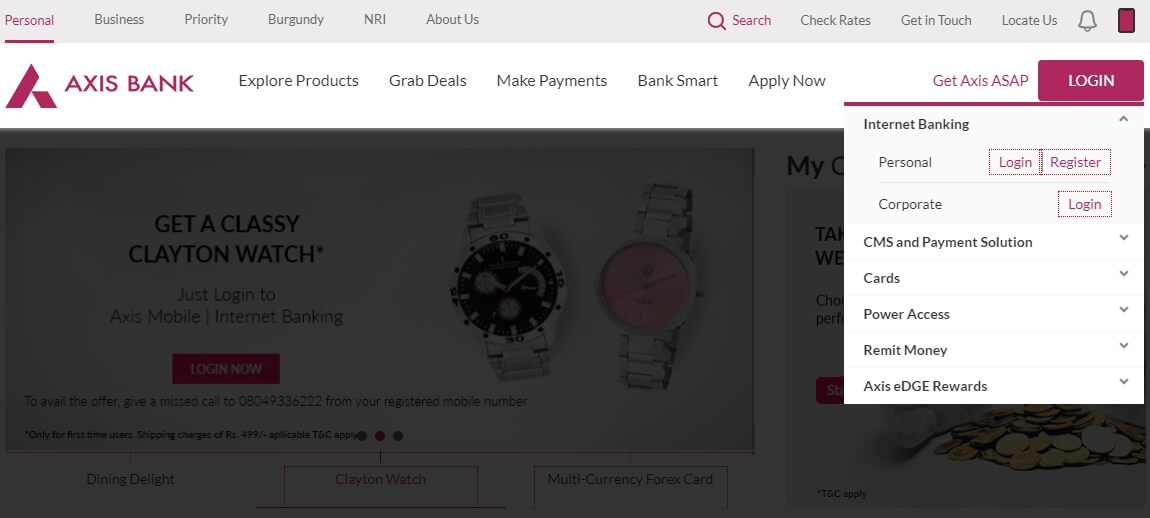

Visit AXIS Bank Official Website

Under this alternative, one needs to visit the axis bank online net banking login page or so-called axis bank official website page.

Visit the same by clicking here — Axis Bank.

Note-1: Always make sure you access websites that have HTTPS security and avoid compromising your critical information to cyber criminals.

Once you outreach to the homepage, look for the “LOGIN” button, attached at the top right corner of the axis bank official website homepage.

The time you find it, press over it. Just by pressing or holding the cursor over it, you will see a drop-down menu list – elaborating the following functions; Internet banking (Personal || Corporate). CMS and payment solution, Cards, Power Access, Remit Money and Axis eDGE Rewards.

An image illustrating the same is as:

Among all, you need to go with Internet banking. To which, you need to select the banking way (Personal || Corporate). Wherein, you need to log in or register yourself with the banking manner would like to go with.

Upon selecting any, you will be redirected to the login page. Keep going…

![]()

Login To AXIS Bank Net Banking

The actual work starts from here…!!!

So, in order to access the axis net banking service — one needs to log in himself or herself over the axis portal via the correct username and password credentials.

Mark-2: If you don’t have the axis net banking account. Then, you need to have one, for the sake of same — file the axis bank online net banking application form @LeadingFile.

The way of doing so and so, and further on-going few steps are as follows:

The time you get logged in to axis bank net banking, you will see a pop-up of the demo from the axis portal itself. The demo will teach you about the entire dashboard, you will be facing that time.

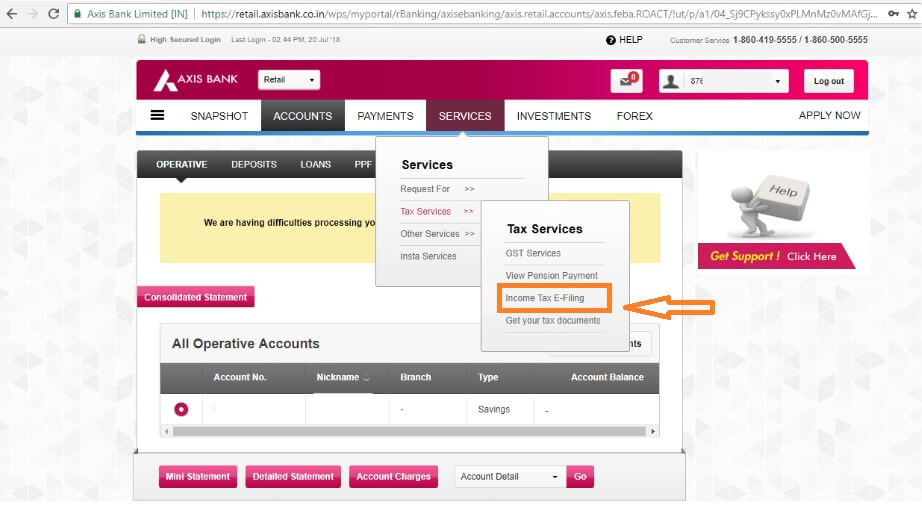

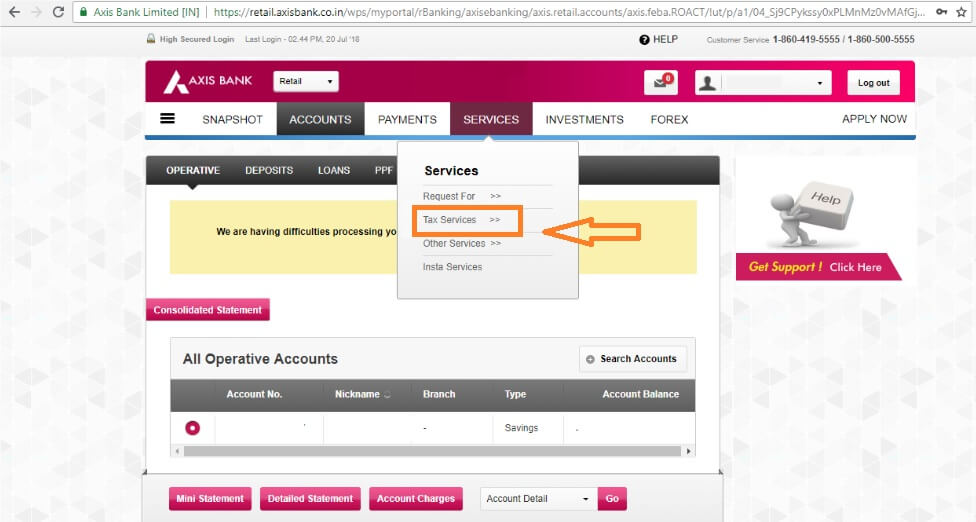

You may skip either learn about the dashboard. Later to that, look for the “SERVICES” button on the top menu of your dashboard.

Must remember that you need not to click over the “SERVICES” button, just take your pointer/cursor over the services button. The time you take your pointer/cursor over that, you will be displayed a drop-down menu containing the following options:

Must remember that you need not to click over the “SERVICES” button, just take your pointer/cursor over the services button. The time you take your pointer/cursor over that, you will be displayed a drop-down menu containing the following options:

- Request For >>

- Tax Services >>

- Other Services >>

- Insta Services

Among all, go with the “Tax Services” option. There also you need to remember that you need not to click over the button, just take your cursor over that…

The time you take your cursor over it, you will be displayed a drop-down menu list on the right side, containing the following options:

- GST Services

- View Pension Payment

- Income Tax E-Filing

- Get your tax documents

Going forth, select the 3rd option i.e “Income Tax E-Filing”.

![]()

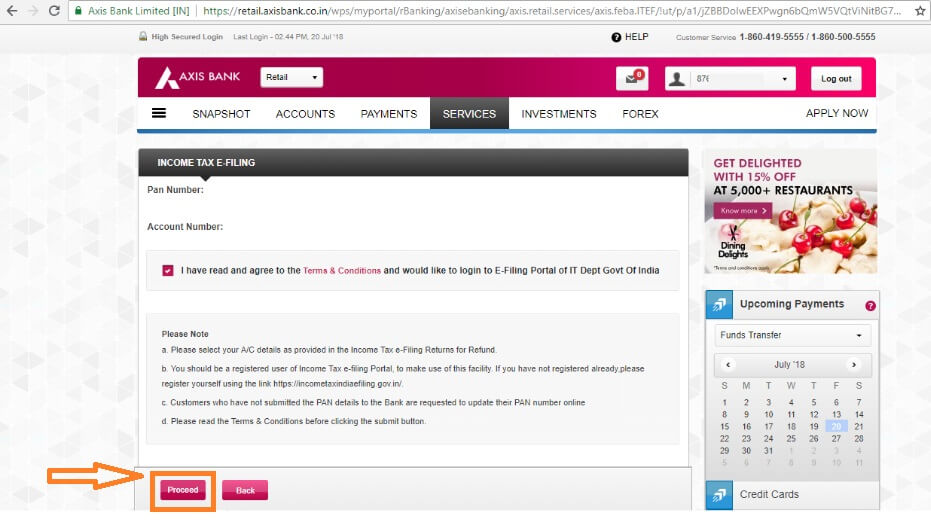

E-File || E-Verify: Income Tax

Here — under this alternative step, you have to e-file or e-verify your income tax returns.

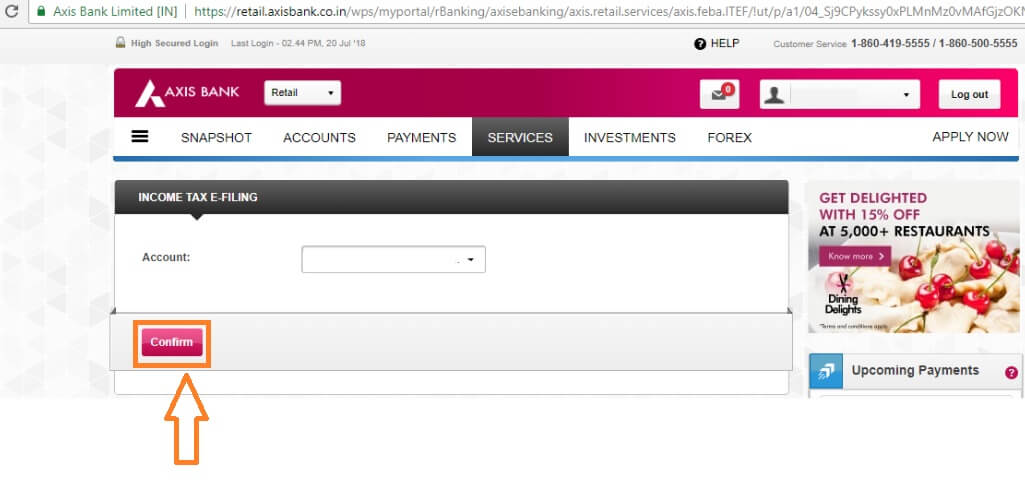

To begin with, you need to select your axis bank account number from the dialogue box by clicking over the down arrow icon. Later to the selection, click over the “Confirm” button to proceed.

A image illustrating the same is as follows:

Next. verify your PAN and Bank Account Number, and later to verifying — accept the Terms and Conditions. Upon verifying and accepting this all, click the “Proceed” button to continue.

What now? Now, your details will be confirmed and later to confirmation, you will be redirected to the — Income Tax India e-Filing Portal. As – keep going…

What now? Now, your details will be confirmed and later to confirmation, you will be redirected to the — Income Tax India e-Filing Portal. As – keep going…

![]()

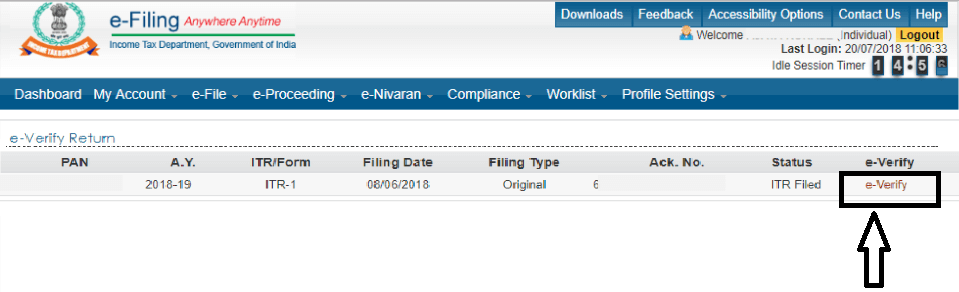

E-Verify Your Income Tax Return

You’re almost there…!!!

Yes-Yes-Yes, almost. Just opt to have few small steps.

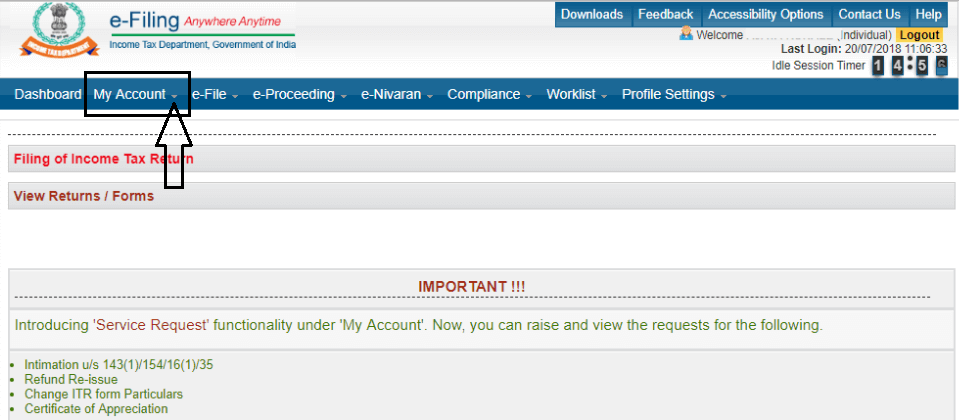

Where the first small step says that from the dashboard you’re redirected to or the dashboard you’re looking at (Income-Tax India filing portal), search for “My Account” tab or button.

An image illustrating the same is as follows:

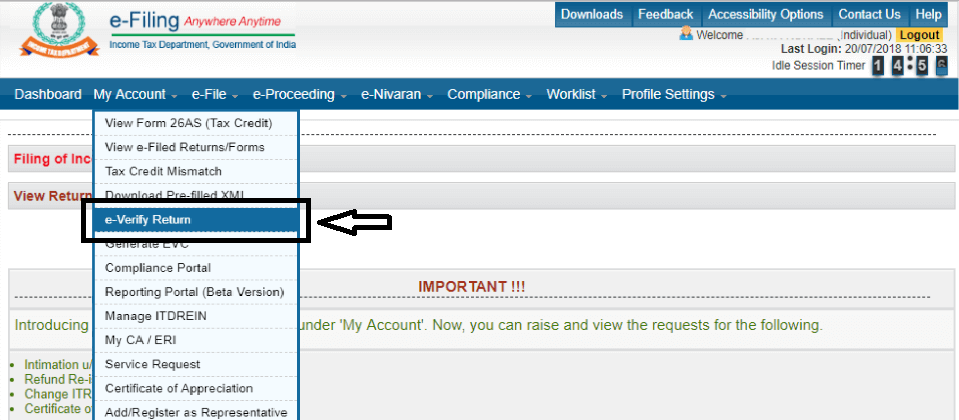

Also remember that you need not to click over that, just take your pointer over the same i.e “My Account” button. Doing so will open a drop-down list, to which you need to select the “e-Verify Return” option.

Have a look…

What next? Next is somewhat which needs to be e-verified. Yes, you will be facing all your returns which are not e-verified till.

So, go against the return which you wish to verify and click over the e-verify link next to it. An image illustrating the same is as follows;

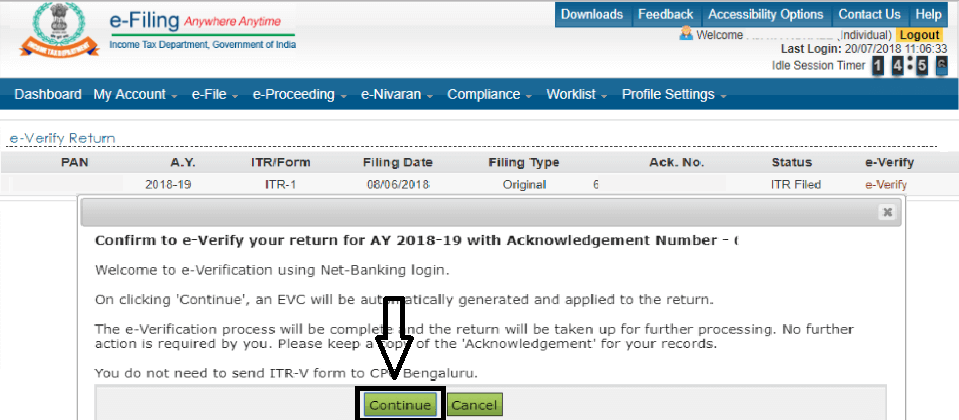

Task didn’t end here, and a big judgement steps is to you. The time you click over it, a pop-up will appear — asking you to continue or cancel the e-verification process of that particular ITR.

Where, judgement “Continue” will take you to the next step whereas judgement “Cancel” will take you back to the same page.

Well, click the “Continue” button at the dialogue prompt to confirm the e-verification of your return for the given financial year.

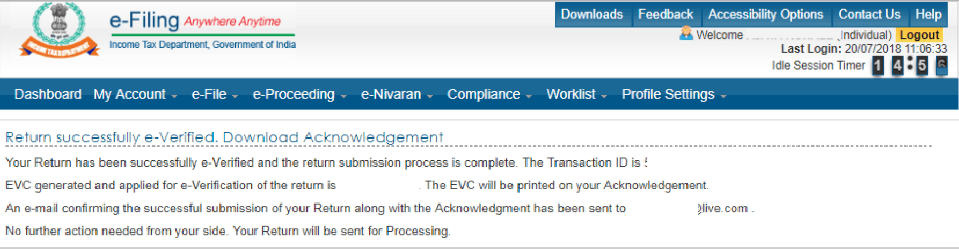

Congratulations, you’re done with the ITR e-verification. A message will be displayed on your screen that your return has been successfully verified and an email confirmation will be sent to your registered ID. Also, you will be provided with an Acknowledgement Number.

Not only this much but you will also be sent a link to download the ITR-V Acknowledgement.

Note-2: If you don’t know how to download the ITR-V Form then click the anchor text as; [simple_tooltip content=’In accordance with the research, at present, the process of downloading ITR-V is not that much difficult. But is over high demand!

Admirably, over 880 users in a month use to search – how to download ITR-V acknowledgement. Ease >> Download ITR-V.’]Download ITR-V: Easy & Native Steps[/simple_tooltip].

Note-3: Be sure to log out from your net banking account after completing the e-verification process.

All done…!!!

Important Things To Keep In Mind And Avoid ITR-V Rejection

Sometimes, an individual may unfortunately end up by getting his or her ITR-V rejected. There are several reasons that can bring about an ITR rejection. However, you can avoid this by keeping in mind a few important things, which are as follows:

- Don’t overwrite information on the ITR V Form.

- Use Digital Signature on the ITR V Form wherever possible.

- Make sure your returns filing date does not exceed the due date.

- Ensure to submit all necessary documents along with the ITR V Form.

- Documents should not be of poor quality and too should not be illegible.

So, if you’re being careful with the procedure and requirements of ITR E-Verification. Then you should have no problems in successfully completing the task.

Hire An Expert At LeadingFile To E-File Your Returns

LeadingFile has been here for many years, guiding clients and providing solutions for filing tax returns through a hassle-free manner.

So, needless to say, speak with our certified CA to get tips, analysis and strategic planning that fits best to your needs. Whether you are a salaried employee or own a business, our experts at LeadingFile can help you e-file and e-verify ITR with ease and from the comfort of your home or workplace.

Get in touch with us today…!!!