How To E-Verify ITR Through

E-Verify ITR Through SBI Net Banking [Official Guide- 2019]

- July 1, 2019

- Posted by: Editorial Team

- Category: Income Tax

![E-Verify ITR Through SBI Net Banking [Official Guide- 2019]](https://leadingfile.com/wp-content/uploads/2019/05/E-Verify-ITR-Through-SBI-Net-Banking-Official-Guide-2019.jpg)

Overview

Probably one of the greatest convenience of today’s era is online e-verification of ITR. So, let’s conclude the same and discuss — how to e-verify ITR through SBI net banking.

However – in this era, the government of India is more likely seemed to be focused on the formula: Go Green || Go Digital. To which they say – make the e-filing process completely paperless.

Wherein, to make this dream come true, they have come up with a process named E-Verify ITR. Under this alternative, anyone-anytime can file his or her tax returns, online by visiting the particular bank’s official website.

Note: To our concern – only selective banks provide the ITR e-verification service. And which those selective banks are? A list illustrating the same is attached to the note point of the article: E-Verify ITR Through NET Banking.

Coming back to the topic i.e E-Verify ITR: SBI Net Banking…

You know what, an individual who pays his or her taxes annually is often considered a responsible citizen – who also contributes to the development of his or her country.

Further on — in accordance with the income-tax act, 1961, citizens of the Indian nation whose earnings fall in the income tax return slab are obligated to file their returns with the income tax department at the end of every financial year.

Thus, with the introduction of electronic verification (E-verification) system by the government of India, filing one’s income tax returns (ITR) have now become a hassle-free experience.

But what this ITR-V in real is? Ease, Keep going…

ITR-V: Income Tax Return-Verification

ITR-V; which commonly stands for Income Tax Return-Verification, is an acknowledgement slip which is generated on submitting returns, online. So, in case you have submitted your returns using a digital signature. Then you are not required to download, sign the ITR-V form and send the same to the Income Tax (IT) Department, physically.

On the other hand, if you do not have a digital signature. Then you will be required to file your Income Tax Returns and send the ITR V Acknowledgment Form physically by post. The method of doing so and so, stepwise is attached as: Offline ITR-Verification Process.

Going forth, in this article, we will guide you through the process of e-verifying your ITR through State Bank of India (SBI) net banking service.

In addition to this, you can always seek assistance from our team of qualified experts at LeadingFile, rendering solutions and services for e-verification of Income Tax Returns (ITR).

E-Verify ITR Through SBI Bank Net Banking Service: Easy Steps

Call it — “E-Verify ITR Through SBI Bank Net Banking Service” or “E-Verify ITR Through SBI Net Banking Service”, both connotes to the same thing.

E-filing is today’s new method used for preparing and submitting ITR (Income Tax Returns), efficiently through the Internet. To which, e-verification is needed for completing the process.

Mark: The process of filing returns will not be considered complete until the returns got e-verified. Therefore to achieve the verification of ITR knock the recommended method i.e net || online banking.

Further on, follow out the steps given below to e-verify your ITR through State Bank of India (SBI) net banking…

![]()

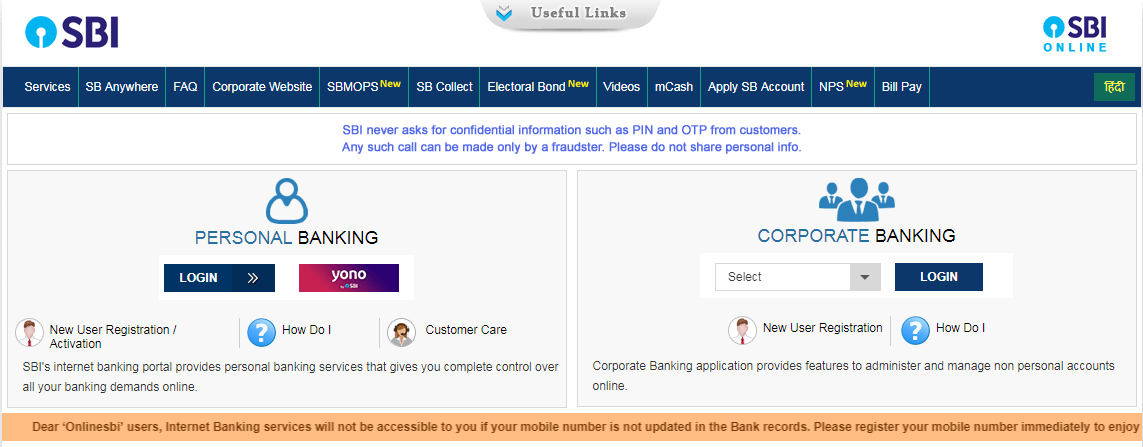

Visit SBI Official Website

The very first step says — go to SBI’s official website. For the sake of same, click the link provided as; Online SBI.

Note: Always make sure you access websites that have HTTPS security and avoid compromising your critical information to cyber criminals.

Next, opt to have the banking login – Personal Banking or Corporate Banking, the way you like to go…

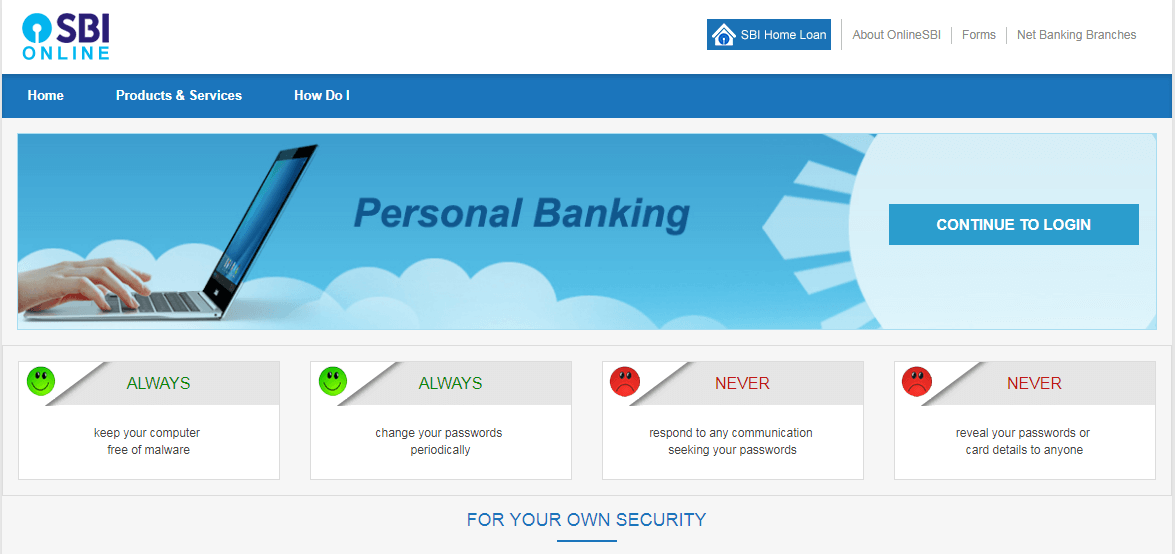

Later to opting the banking method, a window will pop-up; asking you to continue the login. An image illustrating the same is as follows:

Upon selecting the continue option, you will be redirected to the login page. Keep going…

![]()

Login || Register To SBI Net Banking

In order to access SBI net banking service – one need to log in or register himself or herself over the SBI portal through the correct username and password credentials.

The way of accessing, and the further on-going process is represented throughout a GIF, as follows:

Once you’re logged in to SBI account, look for the “e-Tax” button on the top menu of your dashboard.

Remember, you need not to click over that, just take your pointer over the e-Tax button. The time you take your pointer over that, you will be displayed a drop-down menu containing the following options:

- State Govt. Taxes

- Indirect Taxes

- Direct Taxes

- View Tax Credit Statement (Form 26AS)

- Reprint Challan Receipt

- More >>

But which one to select? Ease; among all these options, you need to select the 3rd one i.e ‘Direct Taxes’.

Further on, from the sidebar located on the left, select the “Login to e-Filing/e-Verify”. As…

![]()

Login To E-Filing || E-Verify

As mentioned, select the “Login to e-Filing/e-Verify” button from the left sidebar. Selecting this will take you to the e-filing submission window. All right, now, one needs to confirm all his or her account details and click the “Submit” button to proceed.

A GIF illustrating the same is as follows:

Next, just by clicking on the “Submit” button you will be sent a high-security OTP (One-Time Password) via SMS on the phone number, registered with your bank account.

Once you get the OTP code, enter it into the box provided for same and then click over the “Confirm” button as illustrated in the login to e-verify ITR through SBI net banking GIF.

What now? Now, your details will be confirmed and later to confirmation, you will be redirected to the — Income Tax India e-Filing Portal. As – keep going…

![]()

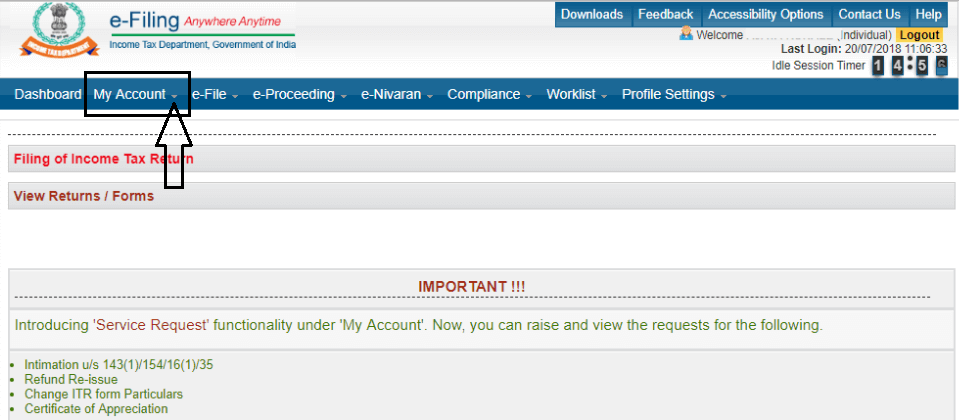

E-Verify Your ITR (Income Tax Return)

Last and the final step, under this alternative – one is redirected to the Income-Tax India filing portal. Fine; but what next?

Next is to look at the same dashboard for “My Account” button and click over the same to proceed.

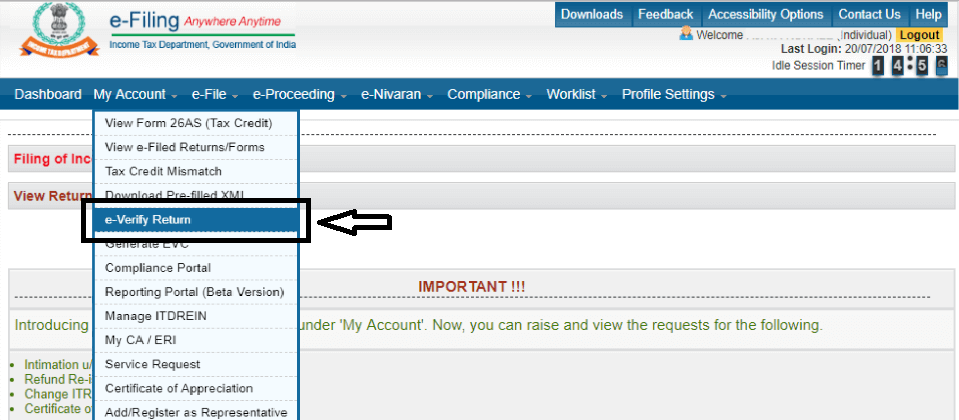

Not to click, just take your cursor over the button. Doing so will open a drop-down list, to which you need to select “e-Verify Return”.

Have a look…

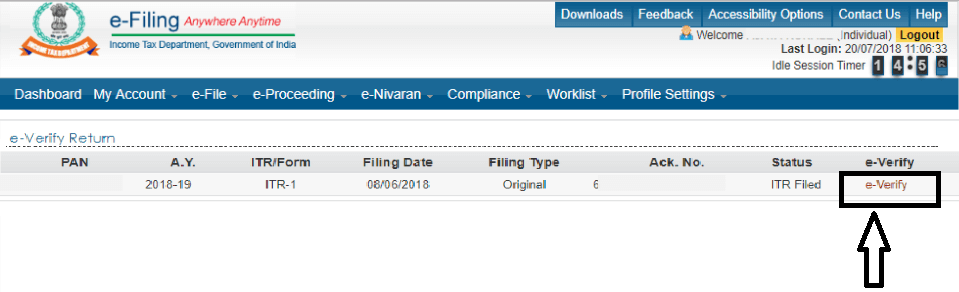

Later to selecting the “E-Verify Return” option, you will be facing all your returns which needs to be e-verified.

Fast forward — go for the return which you wish to verify and click over the e-verify link next to it. An image illustrating the same is as follows;

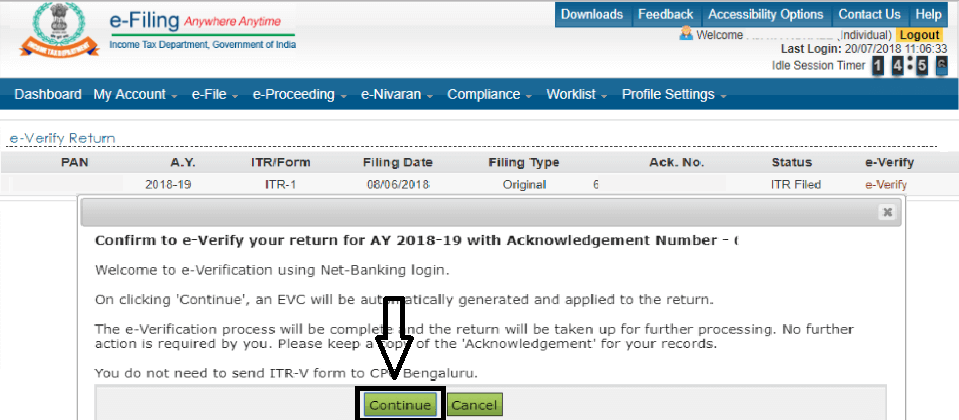

The time you click over it, a pop-up will appear — asking you to continue or cancel the e-verification of that particular ITR.

Opting “Continue” option will take you to the next step whereas opting “Cancel” will take you to the same page.

If you really wish to e-verify that particular ITR (Income Tax Return) then click over the “Continue” button.

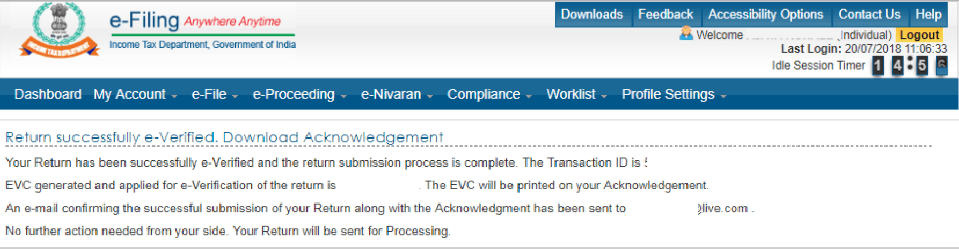

Congratulation, you’re done with the e-verification. A message will be displayed on your screen that your return has been successfully verified and an email confirmation will be sent to your registered ID.

All right. But what is the proof? In order to have the proof, open your registered e-mail ID and download the acknowledgement.

Note: If you don’t know how to download the ITR-V Form then click the anchor text as; Download ITR-V: Easy & Native Steps.

All done…!!!

Important Things To Keep In Mind And Avoid ITR-V Rejection

Sometimes, an individual may unfortunately end up by getting his or her ITR-V rejected. There are several reasons that can bring about an ITR rejection. However, you can avoid this by keeping in mind a few important things, which are as follows:

- Do not overwrite information on the ITR V Form.

- Use Digital Signature on the ITR V Form wherever possible.

- Make sure your returns filing date does not exceed the due date.

- Ensure to submit all necessary documents along with the ITR V Form.

- Documents should not be of poor quality and too should not be illegible.

So, if you’re being careful with the procedure and requirements of ITR E-Verification. Then you should have no problems in successfully completing the task.

Hire An Expert At LeadingFile To E-File Your Returns

LeadingFile has been here for many years, guiding clients and providing solutions for filing tax returns through a hassle-free manner.

So, needless to say, speak with our certified CA to get tips, analysis and strategic planning that fits best to your needs. Whether you are a salaried employee or own a business, our experts at LeadingFile can help you e-file and e-verify ITR with ease and from the comfort of your home or workplace.

Get in touch with us today…!!!