How To E-Verify ITR Through

E-Verify ITR Through IDBI Net Banking [A Helpful Guide @LeadingFile]

- July 1, 2019

- Posted by: Editorial Team

- Category: Income Tax

![E-Verify ITR Through IDBI Net Banking [A Helpful Guide @LeadingFile]](https://leadingfile.com/wp-content/uploads/2019/06/E-Verify-ITR-Through-IDBI-Net-Banking-A-Helpful-Guide-@LeadingFile.jpg)

Overview

Literally, net-banking has made the ITR e-verification process – super easy!

Don’t go so apart, here is an instance — IDBI NET Banking; the most – flexible, opted and preferred one.

Apart from this all, it is very easy to [simple_tooltip content=’E-Verify ITR; in complete stands for e-verification of ITR (Income Tax Return)!

But, what e-verification of ITR means? E-Verification of ITR somehow means electronic verification of the ITR, where the taxpayer verify his/her tax returns via generating EVC (Electronic Verification Code).

And from the known fact…Read More‘]e-Verify ITR[/simple_tooltip] through IDBI net banking. Not only this much but it also includes hardly any big step, in either method of e-verification.

| [simple_tooltip content=’All right, to conclude the depth view, let’s start from the basic…!!!

You know what: e-filing is today’s new method used in preparing and submitting income tax returns (ITR) efficiently through the Internet. But, to this method, e-verification is a must…Read More‘]E-Verify Via IDBI Bank Portal Service[/simple_tooltip] |

[simple_tooltip content=’Of course, it is simpler than that of the above-mentioned method. And why so? Because it hardly asks you to go with 2 steps.

However, in order to e-verify your ITR through IDBI ATM service, please make sure that you have the ATM of IDBI account. Here is the on-going process…Read More‘]E-Verify Via IDBI Bank ATM (Automated Teller Machine)[/simple_tooltip] |

So, let’s start with the goal set [E-Verifying ITR Via IDBI Net Banking]. Here we go…

Certainly, whether you are an owner or a partner of a business or employed at a firm, you will have to give away a part of your income in the form of tax. This tax, in accordance with income tax law – 1961, is mandatory for every individuals having a certain income capacity.

But paying tax is not the end, one – later to paying the tax needs to e-verify that particular income tax return — which we call ITR e-verification (which is also our goals starting phase).

And what this ITR E-Verification is?

Ease; you may also name it ITR-V || [simple_tooltip content=’Concerning the “ITR-V” fact to you – If you had filed your tax returns and till not processed the verification step, then, your whole ITR (Income Tax Return) process is incomplete! Complete it today @LeadingFile‘]ITR-V[/simple_tooltip]; commonly stands for “Income Tax Return Verification or E-Verification”, an acknowledgement slip which is generated on submitting the tax returns online.

Mark-1: In case you have submitted your returns using your [simple_tooltip content=’It Pays Businesses To Recognize The Importance Of Digital Signature!

In saying ~~ “Digital Signature || DSC is ideal for mankind who are active in online transactions”!

Consequently, if you’re serving or holding online transactions by you then scooch to have the digital signature.

‘]digital signature[/simple_tooltip], then you are not required to download, sign the ITR-V Form and send the same to the IT Department.

Mark-2: If you do not have a Digital Signature, then you will be required to file and send the same – physically by post. The method of doing so and so, stepwise is attached as follows: Offline ITR-Verification Process.

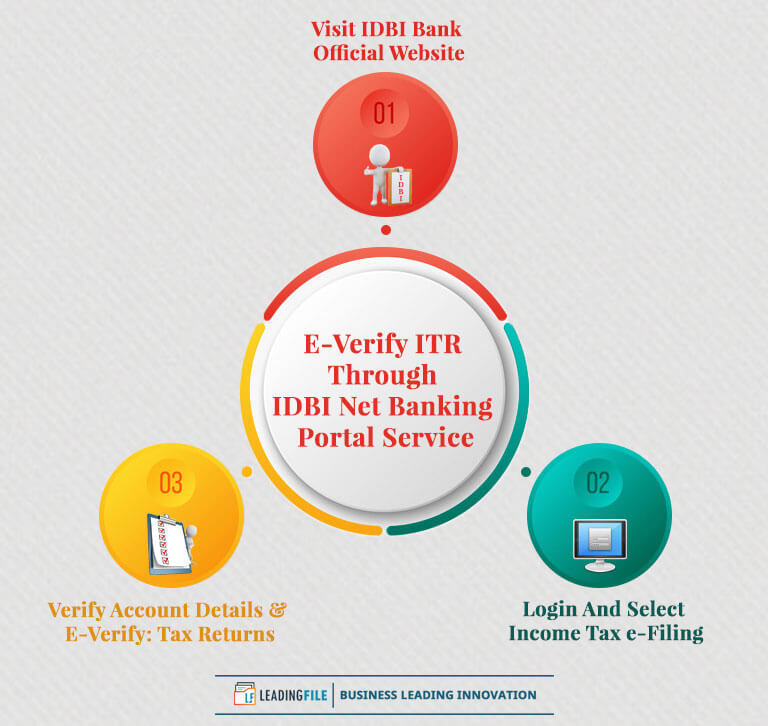

Considering the lifted subject, as — visit the infographics along with the mentioned theory to deal with the same…

E-Verify ITR Through IDBI Bank Net Banking Portal Service: Depth View

All right, to conclude the depth view, let’s start from the basic…!!!

You know what: e-filing is today’s new method used in preparing and submitting income tax returns (ITR) efficiently through the Internet. But, to this method, e-verification is a must. However, e-verification is needed for each and every digital process, and even the entire ITR process is incomplete without e-verification.

And why so? Because the process of filing returns will not be considered complete until the return has been e-verified. So, let’s e-verify ITR with one of the recommended method i.e, net banking or online banking via IDBI bank service.

Note: ITR E-filing is an important process and all the taxpayers, who fall in this slab (i.e., annual earnings is Rs. 5 lakhs and above), must file their returns by the end of each financial year.

Follow the steps given below to e-verify your ITR through IDBI bank net banking portal service…

![]()

Visit IDBI Bank Official Website

Yes, in order to e-verify ITR online via IDBI net banking portal, visit the IDBI bank’s official website.

Subsequently, visit the same by clicking here — IDBI Bank.

Note-1: Always make sure you access websites that have HTTPS security and avoid compromising your critical information to cyber criminals.

Once you out-reach the IDBI portal, look for “Net Banking” — located next to the slider in the right side of the menu bar.

Over there, click the arrow next to personal banking. Doing so will open a drop-down menu list, mentioned as –

- Personal

- Corporate

- Cards

- Samriddhi Portal

- Credit Card

Eventually, select the way you like to go and later to the selection, click over the “Login” button — located next to the particular selected net banking method.

The time you click over it, it will redirect you to the IDBI guidelines and will ask you “Continue to Login” to proceed further.

And once you click over the “Continue To Login” button, it will take you to the IDBI login page. A GIF illustrating the same is as follows –

Login And Select Income Tax e-Filing

In accordance with the flow, now you are looking at the IDBI login page. As seems, it’s asking you to provide the “Customer ID” and “Password” to log in successfully.

So, upon filing the correct credentials, click over the “Login” button. Although, the second you click over it, the next second you will be looking at your IDBI account.

Over this window (IDBI account page), and under the operative account, look for “Income Tax e-Filing” button. A button to which the heading ask you to go along with!

The time you find it, click it…!!!

Found? If not, then don’t panic — wonder the same throughout the GIF, as follows:

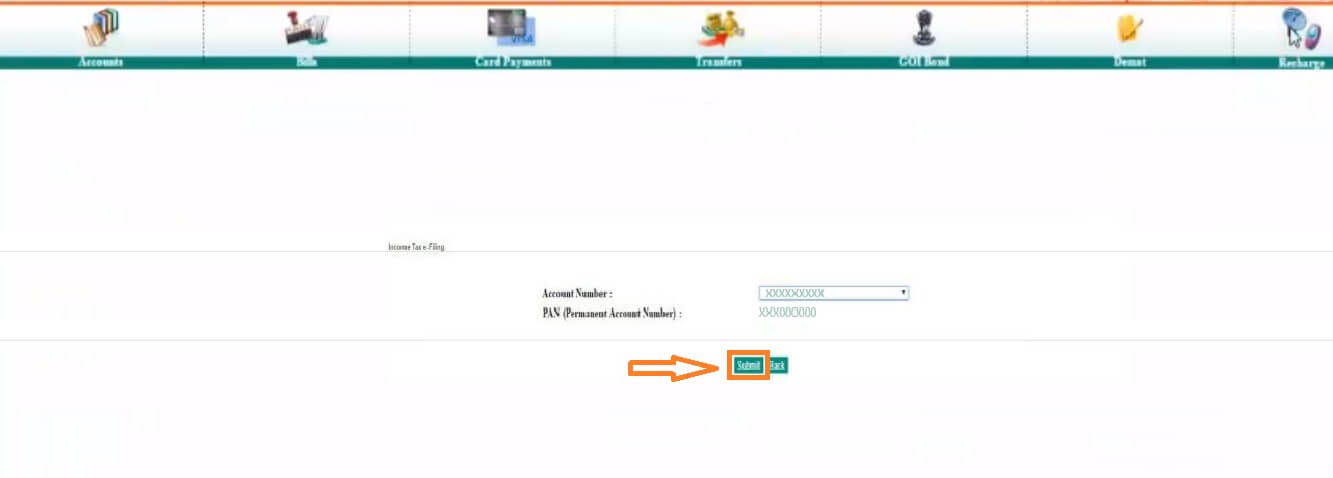

Verify Account Details & E-Verify: Tax Returns

Almost done!

Yes, this is the very last step of ITR e-verification done through IDBI bank net banking portal service.

Ok, got it! But what it asks one to do? Nothing big; it asks one to verify his/her account details. And what those account details are? Ease; Account Number and PAN (Permanent Account Number).

And-And-And, once you are done with the detail verification, click over the “Submit” button. Don’t panic have a look at the image, illustrating the same…

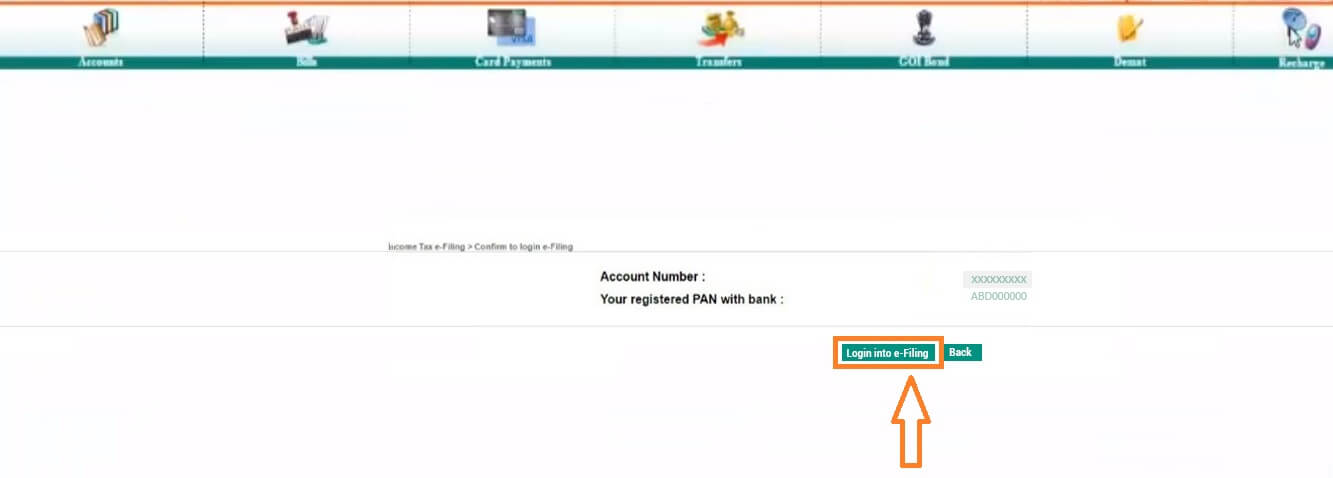

What next? Next, you will be redirected to the confirmation window. Wherein, you need to select the “Login Into E-Filing” button. But remember one thing that you need to click over it only after the confirmation of “account number” and “your registered PAN with bank”.

What next? Next, you will be redirected to the confirmation window. Wherein, you need to select the “Login Into E-Filing” button. But remember one thing that you need to click over it only after the confirmation of “account number” and “your registered PAN with bank”.

Similarly, an image demonstrating the same is as follows:

Going forth, you will be asked to do the same, done alike in all other e-verification options.

Going forth, you will be asked to do the same, done alike in all other e-verification options.

And what that is? Keep going…

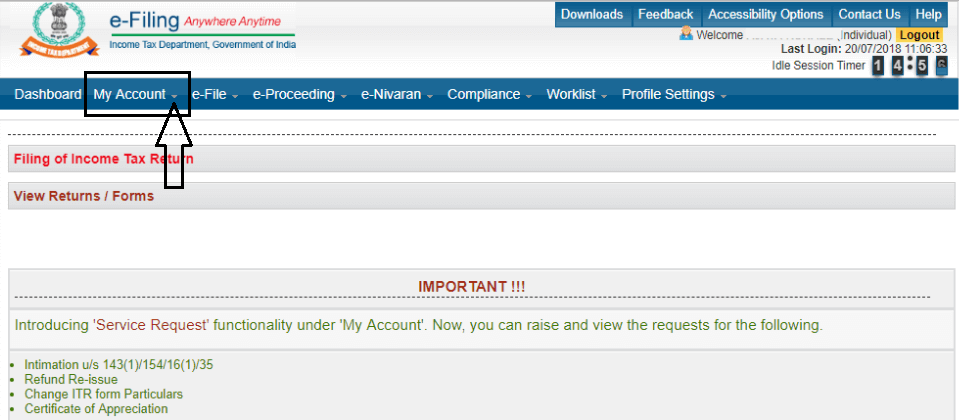

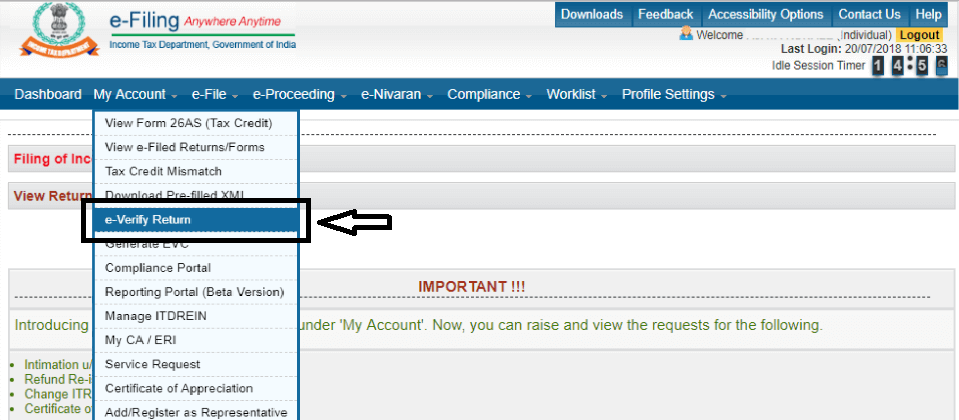

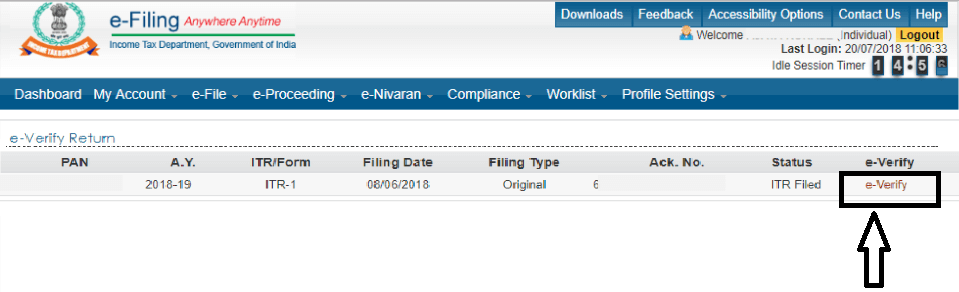

E-Verify your income tax return. Again, you are on the same window of e-verification but now you are looking at the e-filing portal itself. Here, you are supposed to look for “My Account” tab or button — located next to the dashboard tab on the menu bar of the Income-Tax India filing portal.

Have a look here;

But remember one thing, you need not to click over the “My Account” button. Whereas, you are just supposed to take your cursor over the tab or so-called button. The time you do so, a drop-down menu will be to you within no matter time.

The drop-down menu list will be containing the following links –

- View Form 26AS (Tax Credit)

- View e-Filed Returns/Forms

- Tax Credit Mismatch

- Download Pre-Filed XML

- E-Verify Return

- Generate EVC

- Compliance Portal

- Reporting Portal, etc..

An image illustrating the rest link/points are as follows:

But which one to select? As demonstrated and as of our goal post, we are only supposed to click over the “e-Verify Return” link.

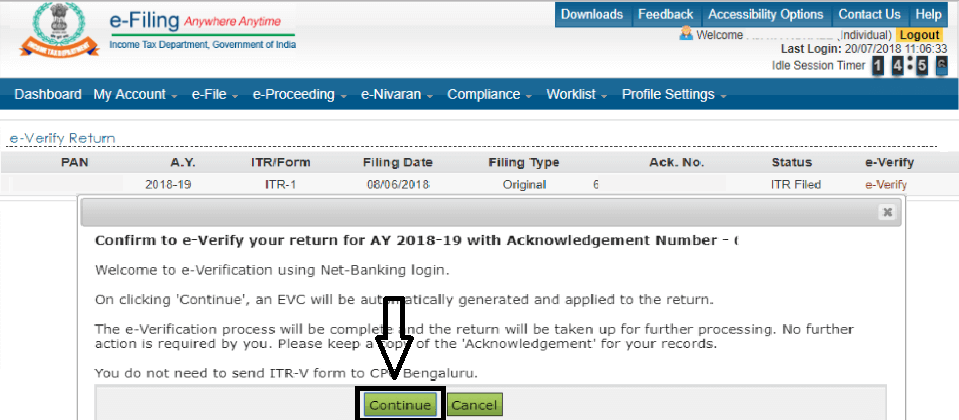

Accordingly, now, you will be facing all your returns which are not e-verified till. Going forth, go against the return which you wish to verify and click over the e-verify link next to it.

An image illustrating the same is as follows;

Certainly, upon clicking over it, as usual — a pop-up will appear asking you to continue or cancel the e-verification process of that particular ITR.

Certainly, upon clicking over it, as usual — a pop-up will appear asking you to continue or cancel the e-verification process of that particular ITR.

Where — judgement “Continue” will take you to the next step whereas judgement “Cancel” will take you back to the pending returns.

As of now, we are here to e-verify return, so, you need to click the “Continue” button at the dialogue prompt to confirm the e-verification of your return for the given financial year.

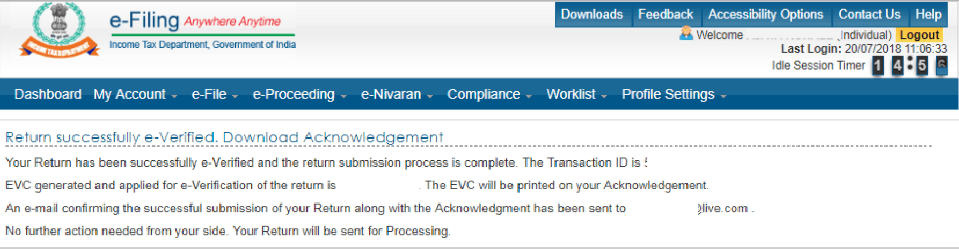

Doing so will display a message on your screen that your return has been successfully verified and an email confirmation will be sent to your registered ID. Also, you will be provided with an Acknowledgement Number.

Not only this much but you will also be sent a link to download the ITR-V Acknowledgement.

Congratulations, you’re done with the complete in-and-out process of e-verifying an ITR (Income Tax Return). And yes. this leads to the end of the e-verification done through IDBI portal service.

But — what if one feels uncomfortable with this method?

Well, it was also an easy process to e-verify the returns. But another much simpler is as follows…

Hire An Expert At LeadingFile To E-File Your Returns

LeadingFile has been here for many years, guiding clients and providing solutions for filing tax returns through a hassle-free manner.

So, needless to say, speak with our certified CA to get tips, analysis and strategic planning that fits best to your needs. Whether you are a salaried employee or own a business, our experts at LeadingFile can help you e-file and e-verify ITR with ease and from the comfort of your home or workplace.

Get in touch with us today…!!!

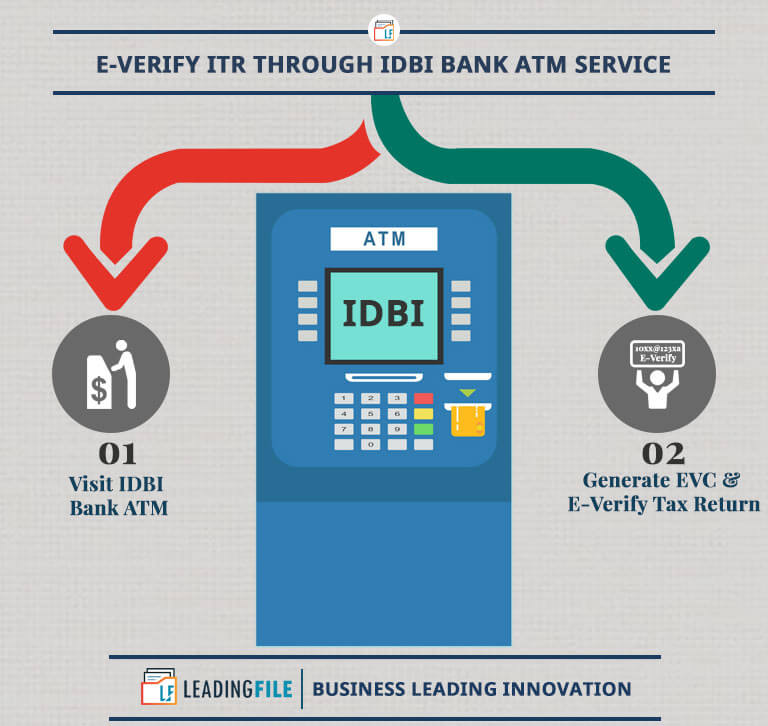

E-Verify ITR Through IDBI Bank ATM Service: Quick & Simpler

Of course, it is simpler than that of the above-mentioned method. And why so? Because it hardly asks you to go with 2 steps.

However, in order to e-verify your ITR through IDBI ATM service, please make sure that you have the ATM of IDBI account.

Here is the on-going process…

![]()

Visit IDBI Bank ATM

Certainly, the first alternative steps ask you to make a visit to the nearest IDBI Bank ATM. Next, once you reach the ATM, swipe your debit card and select the preferred language.

Upon selecting the language, you will be asked to enter the PIN (Personal Identification Number); a four-digit number (xxxx). Enter it from the keyboard, manually. Wait for a second, till the confirmation of your card & PIN is done.

Note: Please make sure that your PIN is not accessible || visible to anyone…!!!

Later to the confirmation, you will be looking a screen — consisting the following options –

PLEASE SELECT AN OPTION

|

Among all, you need to select the last from left ones i.e “Other transactions”. What now? Now is to generate an EVC (Electronic Verification Code). Have a look…

Generate EVC & E-Verify Tax Return

Almost last step, under this alternative — you need to generate an EVC.

Yes, the time you opt the “Other transactions” option, you will be looking to another window, constituting the following options:

WELCOME TO IDBI BANK

|

An image illustrating the same is as follows:

Among all, you need to select the “Generate EVC”. Selecting this will show you a pop-up, displaying the below -illustrated message…

Among all, you need to select the “Generate EVC”. Selecting this will show you a pop-up, displaying the below -illustrated message…

Message: EVC Generation Request has been processed successfully. EVC will be sent to your Registered Mobile Number and Registered email ID with the Income Tax Department. EVC will be valid for 72 hours.

Later to this all, within a few minutes — you will receive a 10 digit alphanumeric EVC from the income tax department on the registered mobile number and also on the registered e-mail ID.

Keep the code safe with you and log-in at the income tax e-Filing portal. Upon logging in, insert the code on the portal to successfully e-verify your ITR.

There-out, you will shortly receive a confirmation message. Straight ahead, look for the mail, you will find a link to download the ITR-V Acknowledgement. Certainly, for downloading it click the “[simple_tooltip content=’

In accordance with the research, at present, the process of downloading ITR-V is not that much difficult. But is over high demand!

Admirably, over 880 users in a month use to search – how to download ITR-V acknowledgement. Ease >> Download ITR-V.

‘]Click here to Download[/simple_tooltip]” attachment link option.

Similarly, an image illustrating the same is as follows:

Image

All done…!!!

Note: Be sure to log out from your net banking account after completing the e-verification process.

Due Date For Filing Income Tax Return

Like every other service, filing your tax returns also comes with a due date. However, it is important to note that exceeding the due date of filing income tax return may land you into legal trouble, along with a penalty of a certain amount.

The due dates for filing income tax returns are as follows:

- 31st July – For individuals not requiring audit under any law.

- 30th September – For companies, business partners of a firm or individuals requiring audit under any law.

- 30th November – Finally, for any individual, whether belonging to corporate or non-corporate who is required to furnish a report on Form No. 3CEB u/s 92E. However, as per the new law, the due date for filing income tax return for the financial year or assessment year is 31st of August.

Penalty For Late Filing of Income Tax Return

As mentioned above, if an individual fails to file his or her tax return at the specified due date, then a fine of a certain amount is levied by the Department of Income Tax.

Thus, as per the new law, individuals who fail to file their income tax returns on or before the due date will have to pay a late fee. However, the income tax department itself decides the late fee amount. And is, therefore, of the following sum:

- Individuals who have filed their tax returns after the due date of 31st July, but on or before 31st December of that assessment year will have to pay a fine of Rs. 5,000/-.

- Individuals who have filed their tax returns after 31st December, but on or before 31st March of that assessment year will have to pay a fine of Rs. 10,000/-.

Note: As for small taxpayers whose total annual income does not exceed Rs. 5 lakhs, the Department of Income Tax has regulated a law that the maximum penalty of Rs. 1,000/- will be levied for the delay in filing one’s income tax returns.